Revolut Bank is a modern financial institution that leverages technology to provide innovative banking solutions, focusing on seamless digital experiences and customer-centric services. Don’t know how to check the revolut exchange rate today, we will help you figure it out.

It offers a range of products including savings accounts, loans, and investment options, all accessible through an intuitive mobile app and online platform. By prioritizing transparency, low fees, and real-time financial management tools, Revolut Bank aims to revolutionize traditional banking and enhance financial accessibility for its customers.

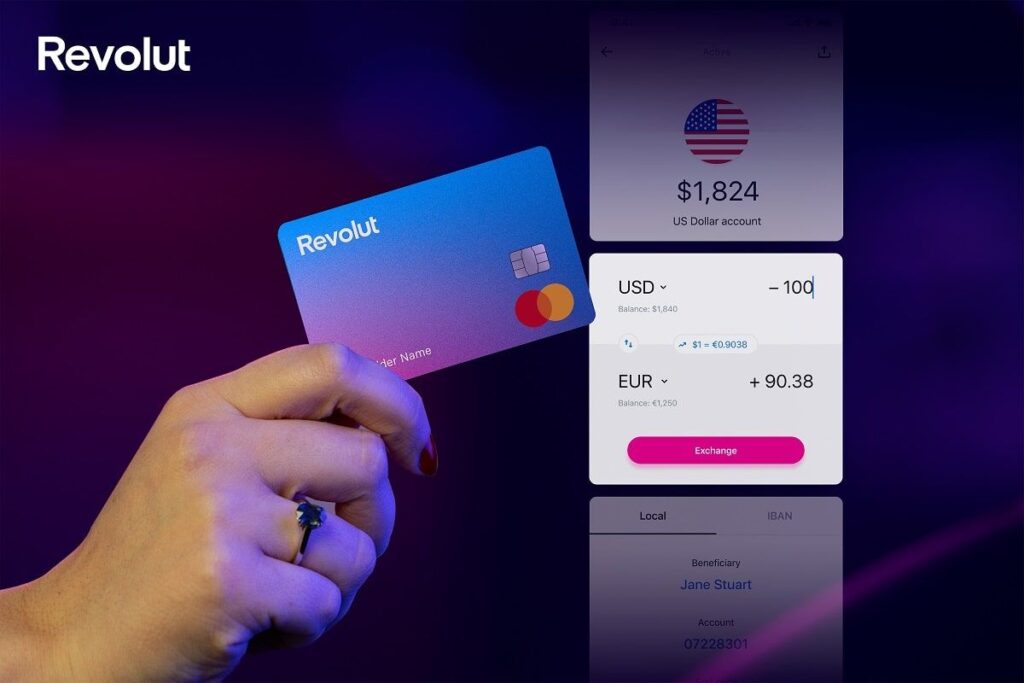

Revolut exchange rate today

Revolut rates provide real-time exchange rates which you can check directly within their app or on their website. These rates are usually very close to the interbank rates, which are among the best you can get as an individual consumer.

Fees in Revolut bank

- Weekday Transactions. On weekdays, if the amount you’re exchanging is within your plan’s fair usage limit, there are no additional currency exchange fees.

- Weekend Transactions. On weekends, Revolut charges a 1% fee on all currency exchanges due to the closure of currency markets.

- Fair Usage Limits. If you exceed your monthly exchange allowance, you will incur a fair usage fee of 1% for the Standard plan and 0.5% for the Plus plan. Premium, Metal, and Ultra plans do not have fair usage fees.

Specific Rates

- USD to EUR. The exchange rate for converting US Dollars to Euros is available directly in the Revolut app and on their website.

- Revolut exchange rate pound to euro. GBP to EUR and GBP to USD. Similar to USD, you can view the live exchange rates for converting British Pounds to Euros and US Dollars in the app.

Revolut exchange rate Pound to Euro

As of the latest available information, the exchange rate from British Pounds (GBP) to Euros (EUR) on Revolut is approximately 1 GBP = 1.1490 EUR.

This rate is continuously updated in real-time based on various independent data sources, reflecting the most current market trends. You can always check the exact and up-to-date exchange rate directly in the Revolut app before making any conversions to ensure you get the latest rate. For the most accurate and up-to-date exchange rates, it is recommended to use the Revolut app or Revolut exchange rate calculator on their website.

What Factors Affect Revolut Exchange Rate Today?

Several factors can influence the exchange rate provided by Revolut today, including:

1. Market Conditions. Revolut’s exchange rates are influenced by real-time market conditions. Fluctuations in supply and demand for different currencies can cause rates to change frequently.

2. Interbank Rates. Revolut uses interbank exchange rates, which are the rates at which banks trade currencies with each other. These rates can vary throughout the day based on economic data releases, geopolitical events, and market sentiment.

3. Trading Hours. During weekends and public holidays, when markets are closed, Revolut applies a markup on the exchange rates. This is because there is less liquidity and higher risk during these periods.

4. Currency Pair. Different currency pairs may have different levels of volatility and liquidity, affecting the exchange rate offered. Major currency pairs (like EUR/USD) typically have tighter spreads compared to exotic pairs (like TRY/JPY).

5. Revolut Fees. Although Revolut often offers competitive rates, the fees and markups can vary based on the user’s account plan. Premium and Metal plan users may benefit from better rates compared to Standard plan users.

6. Economic Indicators. Economic reports and indicators, such as inflation rates, employment figures, and GDP growth, can influence currency values and, consequently, the exchange rates.

7. Political Events. Political stability, elections, and policy changes in a country can affect its currency’s value. Uncertainty or instability can lead to more volatile exchange rates.

8. Central Bank Policies. Interest rate decisions and monetary policies from central banks can have a significant impact on exchange rates. For example, a higher interest rate in one country can attract foreign capital, increasing demand for that country’s currency.

9. Revolut’s Own Liquidity. The availability of currencies within Revolut’s platform can also influence the rates offered. Higher liquidity allows for more competitive rates.

10. Customer Demand. The volume of transactions being processed by Revolut at any given time can impact the exchange rate. High demand for a particular currency can lead to better rates for customers.

Monitoring these factors can help users understand the dynamics behind the exchange rates offered by Revolut and make more informed decisions when exchanging currencies.

Revolutionizing Your Finances with Revolut Exchange Rate Today

Revolutionizing your finances with Revolut exchange rate today involves leveraging the platform’s features to maximize savings and optimize your currency exchanges.

Revolut offers real-time interbank exchange rates, which are typically more competitive than those provided by traditional banks or currency exchange services. By accessing these live rates, you can save money on every currency exchange.

Revolut provides low-cost or even fee-free currency exchanges, especially for Premium and Metal plan users. This minimizes the cost of converting currencies, which can be particularly beneficial for frequent travelers or those with international financial commitments.

With Revolut, you can hold, exchange, and transfer money in multiple currencies without extra fees. This feature is especially useful for expatriates, digital nomads, and anyone who deals with multiple currencies regularly.

Understanding the impact of trading hours on revolut exchange rates can help you plan your currency exchanges better. Since Revolut applies a markup on weekends and public holidays, exchanging currencies during weekdays can save you money.

Using your Revolut card abroad allows you to spend in local currencies at competitive exchange rates. This avoids the high fees and poor exchange rates often associated with traditional bank cards and currency exchange services.

Revolut allows you to set up rate alerts for specific currency pairs. You’ll receive notifications when your desired rate is available, enabling you to exchange at the most opportune moments.

Revolut is transparent about its fees and exchange rates. By avoiding hidden fees, you can better manage your finances and avoid unexpected charges.

Stay informed about central bank policies and economic indicators that influence currency values. Revolut’s competitive rates are a reflection of these factors, and being aware of them can help you time your exchanges more strategically.

Revolut offers robust security features, ensuring your funds are safe. The convenience of managing everything from a single app also simplifies financial management and enhances control over your money.

Practical Steps to Maximize Benefits

- Regularly check the app for real-time rates and plan your exchanges when rates are most favorable.

- Use rate alerts to get notified when the rates meet your target.

- Consider a Premium or Metal plan if you frequently exchange currencies or travel abroad to benefit from lower fees and better rates.

- Exchange currencies during weekdays to avoid the additional markup.

- Utilize your Revolut card for international spending to get the best rates and avoid transaction fees.

By leveraging these features and understanding the factors that influence Revolut exchange rate today, you can effectively revolutionize your financial management, making your money go further.

Overall, Revolut offers a range of innovative and user-friendly financial services, particularly advantageous for tech-savvy users and frequent travelers. However, potential customers should be aware of its limitations and consider how well its features align with their specific needs and banking habits. You can also find out about this bank’s overdraft.